#account tally course

Explore tagged Tumblr posts

Text

Is Tally ERP 9 Certificate Course Open A Door For Your Career In Accounting?

Boost your accounting career with an Account Tally course! The Tally ERP 9 certificate course equips you with vital financial management skills. Learn Tally online and enhance your job prospects in the field of accounting. Enroll today!

#account tally course#tally erp 9 certificate course#tally course near me#tally erp course near me#tally course#tally certificate course#tally with gst course in kolkata#tally gst course fees in kolkata#tally course online#learn tally online#online tally course with gst with certificate#online tally course with gst

0 notes

Text

How Accounting And Tally Courses Can Help Students In Their Productive Future?

Accounting and tally classes are becoming increasingly important for students who want to pursue a career in finance or accounting. These classes provide students with the skills and knowledge they need to succeed in the field.

Learn More: https://www.edunuts.in/how-accounting-and-tally-courses-can-help-students-in-their-productive-future/

#account tally course#best account classes near me#accountant course duration#accounting and taxation course#accounting course#accounting certificate programs near me

0 notes

Text

Using Tally for E-commerce businesses: A complete guide

E-commerce businesses need correct financial control and tax compliance in a fast-paced virtual global. Tally, a sturdy accounting and ERP software program, simplifies dealing with budget, GST compliance, and day by day operations. This manual, "using Tally for E-trade businesses: A comprehensive manual," explains how Tally can streamline and enhance your business approaches.

Why Tally is essential for E-commerce businesses

within the world of e-commerce, agencies deal with excessive transaction volumes, a couple of price gateways, and stringent compliance necessities. Tally simplifies those complexities with capabilities tailored for cutting-edge companies:

Green economic management: Tally automates bookkeeping tasks like invoicing, price tracking, and ledger management.

GST Compliance: The software program ensures correct goods and services Tax (GST) calculations, a critical element for Indian groups. It also enables submitting returns seamlessly.

Stock control: E-commerce platforms handle a significant variety of products, and Tally’s inventory control ensures smooth stock tracking.

Customizable reviews: Tally generates insightful reviews to help you make knowledgeable business choices.

By way of learning those features, entrepreneurs can streamline their accounting processes, lessen human errors, and cognizance on scaling their ventures. For the ones trying to dive deeper, enrolling in a Tally Course in Kolkata can provide the essential capabilities.

Key features of Tally for E-commerce

GST Integration E-trade companies should comply with GST policies, making Tally a useful tool. With its inbuilt GST module, Tally helps the subsequent:

Computerized GST calculations for income and purchases.

Simplified GST filing processes.

Reconciliation of GST returns.

Entrepreneurs can don't forget a GST Course in Kolkata to decorate their understanding of GST submitting and compliance.

Multi-location control E-commerce businesses often function across multiple places. Tally facilitates:

Centralized manipulate of budget for all locations.

Consolidated reporting and analysis.

Inter-branch stock switch monitoring.

payment Gateway Reconciliation Managing more than one charge gateways can emerge as cumbersome. Tally simplifies the method by way of:

Recording payments and receipts automatically.

Reconciling payment gateway money owed with bank statements.

Stock control

Efficient inventory control is crucial for e-commerce success. Tally’s functions include:

Actual-time stock degree updates.

Batch and expiry control for product categories.

Reorder level settings to save you stockouts.

Putting in place Tally for E-trade

To maximize Tally’s potential, proper configuration is vital. right here’s a step-through-step manual:

Step 1: installation Tally ERP 9 or Tally prime

Make sure you have got the modern version to get entry to superior capabilities. deploy and prompt the GST module for seamless compliance.

Step 2: Create a organization in Tally

Go to the principle menu and pick “Create organization.”

Input crucial information like agency call, address, and GSTIN.

Configure taxation settings for GST compliance.

Step 3: Installation inventory and inventory classes

Categorize products based totally on SKU, batch, or place.

Enter opening stock details for accurate inventory monitoring.

Step 4: Configure payment Gateways

Create ledger accounts for each fee gateway.

Map these debts to corresponding transactions for automated reconciliation.

Step 5: allow Multi-currency Transactions (if relevant)

For agencies managing international clients, spark off multi-forex aid to simplify overseas transactions.

Dealing with GST Compliance with Tally

One in every of Tally’s standout capabilities is its strong GST compliance module. here’s how e-commerce organizations can leverage it:

GST Registration and Configuration

Register your business below GST and update your GSTIN in Tally.

This allows seamless GST tracking for transactions.

Generate GST Invoices

Tally allows you to create GST-compliant invoices with the required information, along with:

HSN codes for merchandise.

Tax prices (CGST, SGST, IGST).

Opposite fee mechanism (if relevant).

record GST return

Use Tally’s GST go back filing feature to:

Generate GSTR-1, GSTR-3B, and different relevant paperwork.

Validate records to avoid errors throughout submission.

Add returns at once to the GST portal.

For the ones new to GST strategies, enrolling in a Taxation Course in Kolkata can help build foundational know-how.

Customizing reviews for higher Insights

Tally’s reporting abilities permit organizations to live beforehand inside the competitive e-commerce landscape. Key reviews include:

Income evaluation: discover excellent-selling products and seasonal traits.

Expense reports: music operational fees and optimize spending.

Earnings and Loss statement: advantage a clean photograph of monetary fitness.

To beautify your ability to research such reports, an Accounting course may be useful.

Integrating Tally with E-trade systems

Seamless integration between Tally and your e-commerce platform can store effort and time. popular strategies consist of:

API Integration

Use APIs to synchronize order information, inventory levels, and economic records between platforms like Shopify or WooCommerce and Tally.

third-birthday party Connectors

Cumerous equipment, consisting of Zapier, provide ready-made connectors to integrate Tally with e-trade structures.

guide information Import/Export

For smaller operations, exporting facts from the e-trade platform and uploading it into Tally is a practical answer.

Conclusion

Tally gives e-commerce corporations a effective toolkit to streamline operations, manipulate budget, and ensure compliance with GST guidelines. From stock management to charge gateway reconciliation, the software program addresses every important project faced with the aid of e-commerce entrepreneurs.

#accounting course in kolkata#taxation course#tally course#gst course#gst course in kolkata#taxation course in kolkata#accounting course#tally course in kolkata

0 notes

Text

Top 4 Ways About How Inventory Management Impacts Financial Statements

Inventory management is one of the most crucial aspects of any organization since it forms the basis of its operations. It guarantees that the products to be used are available when needed to address clients’ needs without incurring unnecessary expenses.

However, in addition to operational efficiency, inventory management is vital in the development of a company’s financial statements. From affecting profit to affecting cash flow, the way inventory is handled can significantly affect the financial health of a company. Let’s explore four ways inventory management affects financial statements.

1. Impact on Cost of Goods Sold (COGS)

The Cost of Goods Sold (COGS) is the best way of determining the exact cost incurred for producing or acquiring the goods sold by the firm. Inventory is directly related to this figure, which is indicated on the income statement.

1.1 Inventory valuation methods

The manner that is used to value inventories, which includes the first-in-first out basis, last in-first-out basis, and the weighted average cost, has a powerful impact on the cost of goods sold.

1. FIFO

It results in lower COGS during periods of rising prices, boosting net income but increasing taxes.

2. LIFO

It leads to higher COGS, reducing net income but offering tax advantages.

1.2 Stock management

Excessive inventories or stock is a great danger since they entail more holding costs, which may include deterioration and or obsolescence, which will increase the cost of goods sold. On the other hand, stockouts can affect sales productivity as well as revenues since stockouts trigger sales losses. Adequate and accurate stock management help in presenting the exact picture of business operations through calculation of the COGS.

2. Influence on balance sheet components

Inventory is another important current asset that must be on the balance sheet. Inefficient stock management is capable of annoying the balance sheet which leads to inefficient, impaired or unsafe finances.

2.1 Overstocking

High inventory levels increases the value of current assets which is actually a loss because the money used is tied up and unavailable for strategic investments. This also leads to increased levels of obsolete stock hence write offs and write downs therefore is a factor that contributes to the increase in the cost of goods sold.

2.2 Understocking

Stock out situation is the most costly situation to the overall supply chain for it results in reduced sales and revenues. Of course, it can be disguised as a decline in assets, but left unsolved, the lost sales and dissatisfied consumers are damaging in the long run.

Hence, inventory turnover ratios obtained based on inventory levels and COGS represent one more aspect of inventory management; in addition, they affect the perception of investors and creditors about the company’s operational efficiency.

3. Effects on cash flow statements

Inventory purchases directly affect the cash flow statement under operating activities. Mismanagement can cause much imbalance in the sources and uses of funds.

Excessive purchases Aggressive procurement, such as before full stocks to capture a bargain or to cover for a certain vacuum may well sound wise, but it leads to cash constraint and funds lockup.

Slow-moving inventory Items that take longer to sell delay cash inflows, impacting the company’s ability to meet short-term obligations.

When the inventories are well replenished, companies are in a position to finance other productive areas within their operations.

4. Impact on net income and profit margins

Net income, a key figure on the income statement, is heavily influenced by inventory management. Poor practices can erode profit margins, even if sales are robust.

Shrinkage and obsolescence Inventory losses due to theft, damage, or spoilage reduce gross profit. Regular audits and implementing robust tracking systems can mitigate these losses.

Discounting Overstocked inventory often leads to markdowns to clear excess stock, directly impacting profit margins.

Efficient inventory management ensures optimal stock levels, minimizing losses and maintaining healthy profit margins.

The broader implications for financial statements

Inventory management not only affects individual components like COGS, current assets, and cash flow but also shapes a company’s overall financial health. For instance, poor inventory practices can lead to

Lower Earnings Per Share (EPS) Reduced profitability impacts EPS, making the company less attractive to investors.

Credit challenges High inventory levels relative to sales can deter creditors, signaling inefficiency and potential cash flow issues.

On the other hand, effective inventory management enhances financial transparency, builds investor confidence, and supports long-term growth.

Conclusion

Inventory management goes beyond being a logistic function as it is a financial decision that impacts several factors in financial statements. In other words, cost management, cash flow and profitability can be made optimal when inventory is controlled effectively.

When one wants to learn more about how financial choices such as inventory control affect financial reports, taking an accounting course online is useful.

At Super 20 Training Institute, we offer top-notch accounting courses designed to empower aspiring professionals and entrepreneurs. Learn from industry experts, master critical accounting principles, and take your career to the next level. Visit us today and transform your understanding of finance!

0 notes

Text

TALLY PRIME COURSE

Tally Prime with Advanced GST not only simplifies tax calculations but also enhances business insights with its detailed GST reports, helping businesses track tax credits, liabilities, and payment statuses. The software ensures seamless integration with accounting, inventory, and payroll, allowing for end-to-end GST compliance without switching platforms. With automated reconciliation of input and output taxes, it reduces the chances of discrepancies and penalties. Businesses can handle complex GST transactions like export, import, and job work with ease, ensuring tax accuracy across all operations. The system allows businesses to maintain and manage tax-specific accounting entries, making it simpler to segregate GST-related financial data. Tally Prime also supports a flexible tax filing process with customizable templates that adapt to business-specific requirements. Additionally, it provides automated reminders for tax due dates, preventing late submissions and ensuring timely filings. The software is continuously updated to meet the latest regulatory changes, keeping businesses compliant with minimal effort. Finally, the intuitive interface is designed to accommodate both beginners and advanced users, offering a straightforward yet powerful solution for managing GST effectively.

#Account With tally prime course in india#Online account with Tally Prime course in india#Online account with tally prime course with certificate#Online learning platform

0 notes

Text

Why Should You Take the Google Analytics Course for Digital Marketing?

Understanding your audience and the ability to measure your efforts are crucial when diving into digital marketing. A Google Analytics Course in Ahmedabad equips you with the skills to track website traffic, analyse user behaviour, and make data-driven decisions that will boost your marketing strategies and enhance your online presence.

Master Website Traffic Analysis

Google Analytics Course in Ahmedabad can help you track which page visitors are coming from, land on, and hang around to see, and for how long. You will be shown how to interpret the data, which marketing channels provide the highest return, and how one should adjust the strategy at any given moment. To make sure that you place your time and resources accordingly, invest in those sites that give you the biggest desirable results.

Understand Audience Demographics

Knowing who the audience is, including basic information such as age, location, and interests, will enable them to produce content that helps fulfil their needs. It is for this reason that a Google Analytics Course in Ahmedabad will enable you to show how you can access information about the demographics of these individuals in order to know how best to create appropriate campaigns targeting them and how to better engage them with your message.

Enhance Conversion Tracking

Conversions, such as signing up for newsletters or buying a product, are important gauges of your marketing performance. With a Google Analytics course, you will be taught how to set up and track goals, showing you how your website effectively converts visitors into customers. It helps you understand and further improve your site for better conversion rates.

Improve Content Performance

Not all content is created equal. Certain pages and information draw in visitors, motivating them to spend much more time than others do. Knowing the ins and outs of how to use Google Analytics assesses which content best stimulates interest and why. Having that insight into the strengths will help you develop materials later on that really resonate with your audience and meet your marketing goals.

Enhance Your Career Prospects

In the modern job scenario, Google Analytics is one of the skills in high demand in the digital marketing professional workforce today. Completing the course will not only upgrade your capability but also add a crucial certification to your resume and make you more competitive.

Time to take your digital marketing one step ahead? Then why not enroll in Perfect Computer Education's Google Analytics course in Ahmedabad and see the magic of transforming your data into actionable insights? Visit our website to enrol in this course.

Read More:- https://perfecteducation.net/why-should-you-take-the-google-analytics-course-for-digital-marketing.php

#digital marketing course in ahmedabad#foreign accounting training#learn accounting in ahmedabad#usa accounting training#myob training#quickbook training ahmedabad#foreign accounting and taxation training#xero training in ahmedabad#tally certification in ahmedabad#learn foreign accounting ahmedabad#Google Analytics Course

1 note

·

View note

Text

Unlock Your Career Potential with a Tally Advanced Course

Looking to enhance your accounting and financial management skills? A Tally Advanced Course is your gateway to mastering professional accounting and business management. Designed for students, working professionals, and entrepreneurs, this course equips you with the expertise needed to handle complex financial scenarios using Tally, one of the most trusted software solutions worldwide.

Why Choose a Tally Advanced Course?

Comprehensive Skill Development: Gain in-depth knowledge of financial accounting, inventory management, taxation, and payroll.

Practical Learning: Hands-on experience with Tally features like GST compliance, multi-currency management, and financial reporting.

Industry Recognition: Become certified in Tally, enhancing your resume and career prospects.

Flexibility: Suitable for individuals from varied professional backgrounds, whether you're a beginner or seeking advanced skills.

What to Expect from a Tally Advanced Course?

Expert-led training sessions.

Real-time project simulations to ensure industry-ready skills.

Extensive support for doubts and queries.

Ready to take the next step in your career? Check out the Tally Professional Course for a structured and advanced learning experience.

Invest in yourself today and pave the way for a successful career in accounting and financial management!

0 notes

Text

TALLY PRIME COURSE

Tally Prime is a powerful business management tool designed to streamline tasks related to accounting, inventory, payroll, and taxation. This course offers a comprehensive step-by-step approach to mastering Tally Prime, suitable for both novices and experienced users. You will discover how to create ledgers, log transactions, and produce financial reports effortlessly. Additionally, the course includes advanced subjects such as GST compliance, e-invoicing, and bank reconciliation. Through practical exercises and real-world scenarios, you’ll acquire hands-on experience in utilizing the software effectively. Whether you’re overseeing a small business or looking to enhance your accounting abilities, this course prepares you for success. By the conclusion, you will feel assured in managing financial responsibilities accurately with Tally Prime.

#Account with Tally prime course#Online account with tally prime course in india#Online account with tally prime course with certificate#Account with tally prime course in Punjab

1 note

·

View note

Text

Tally prime with advance gst

Tally Prime with Advanced GST is a powerful business management software that fully integrates GST compliance features, automating complex tasks like tax calculations, return filing, and data reconciliation. This ensures businesses meet all GST requirements without hassle. It simplifies the process of creating GST-compliant invoices, allowing automatic calculation of CGST, SGST, and IGST based on transaction types, and generates detailed sales and purchase reports. The software supports multiple GSTNs, helping businesses manage GST filings across different states, and also handles Reverse Charge Mechanism (RCM) transactions seamlessly.

#Tally prime with advance gst course in India#Account with tally prime with advance gst course in Punjab#Tally prime with advance gst#Online account with tally prime course in india#Account course online with certificate#Online account course with certificate#Online learning platform

1 note

·

View note

Text

TALLY PRIME WITH ADVANCE GST

Tally Prime with Advanced GST streamlines GST management by automating return filing, tax calculations, and reconciliation, ensuring compliance with ease. It also offers real-time tracking of input tax credits, multi-state tax handling, and detailed GST reports for audits and filing.

#Account with tally prime erp 9 course in india#Account with tally prime with erp 9 course in punjab#Account with tally prime erp 9 course in khanna#Account with tally prime erp 9 online course in india#Account with tally prime erp 9 online course in punjab\

1 note

·

View note

Text

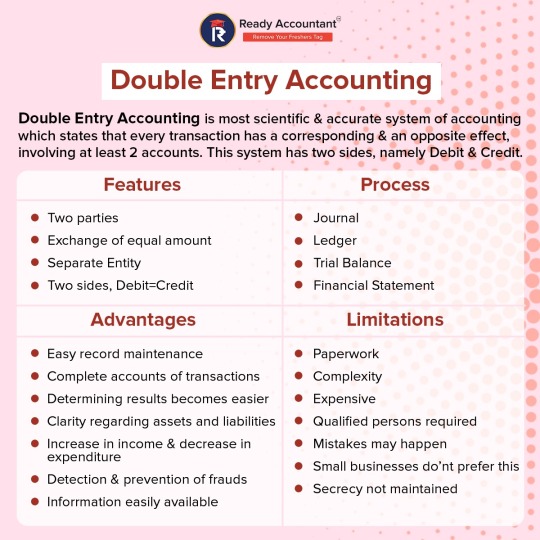

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

Master Tally ERP 9 & GST | Learn Tally Online with Expert Courses

Master Tally ERP 9 and GST with an expert account tally course. Enroll in the Tally GST course at George Telegraph Institute of Accounts and learn Tally online today!

#account tally course#tally erp 9 certificate course#tally course near me#tally erp course near me#tally course#tally certificate course#tally with gst course in kolkata#tally gst course fees in kolkata#tally course online#learn tally online#online tally course with gst with certificate#online tally course with gst#gst tally course#tally academy near me#tally computer course#tally training online#study tally online#tally erp 9#tally erp#tally gst course#tally with gst course#online tally course#tally course fees#fees for tally course

0 notes

Text

Do you want to know about tally gst course fees in kolkata and looking for online tally course with gst with certificate in Kolkata? George Telegraph Institute of Accounts provides you online tally erp 9 certificate course and 100% Placement Guarantee. Visit now.

#tally gst course fees in kolkata#account tally course#certificate course in tally 9 erp#tally erp 9 certificate course#tally course near me#tally erp course near me#tally course#tally certificate course#tally with gst course in kolkata#tally course online#learn tally online#online tally course with gst with certificate#online tally course with gst

0 notes

Text

Push Yourself to Success!

Your journey to greatness begins with a single step of determination, and nobody else will do it for you; take charge of your dreams and make them reality.

For more details visit: Ready Accountant

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course#success

0 notes

Text

The key differences between Assets and Liabilities: From ownership and revenue generation to obligations and financial calculations, this guide breaks down the essentials for financial clarity.

If you want to know more visit: Ready Accountant

#accounting course#gst course#taxation course in kolkata#gst course in kolkata#tally course#taxation course

0 notes

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes